- Find Driver License Number By Ssn Illinois

- Find Drivers License Number Using Ssn Lookup

- Finding Drivers License Number Using Ssn

- Find Driver License Number By Ssn Indiana

Driver's License Calculator: Florida. Calculate your Florida Driver's License number from your information. Reverse analyze an existing number. Contact the Social Security Administration to report fraudulent use of your Social Security Number. Contact the passport office to alert them to anyone ordering a passport fraudulently in your name whether you have a passport or not. Call the fraud unit of the Division of Driver Licenses to see if another license has been issued in your name. Military records since 1967 use the person's Social Security number as an identifier. Check with the funeral home that handled arrangements -they may have a record of the deceased's Social Security number. A life insurance policy or death claim may list it. Some states use the Social Security number as a driver's license number.

In this article:

Identity theft is a major problem in the United States. According to consulting firm Javelin Strategy & Research, 13 million consumers fell victim in 2019—and it cost them $3.5 billion in out-of-pocket costs.

In the United States, The Social Security number (SSN) is a nine-digit number issued to U.S. Temporary (working) residents, permanent residents, and citizens. It is issued to an individual by the Social Security Administration. Now, The SSN has become a de facto national identification number for taxation and other purposes. You should also contact any other entities that identify you using your DL or ID number. Georgia Law prohibits the customers Driver's License (DL) or Identification Card (ID) from being the same as the Social Security number (SSN). This is to protect the customer’s personal identification information.

With technology evolving so rapidly, fraudsters now have more opportunities than ever before to access your private data for their own gain. Safeguarding sensitive information can help protect you from becoming a victim. In addition to being proactive, knowing how to spot fraudulent activity that's already occurred can help you prevent further damage and potentially regain your losses.

There are many different types of identity theft and fraud, including some lesser-known schemes that could wreak havoc on your financial life if undetected. Here's what to look out for and, most important, what to do if it happens to you.

Account Takeover Fraud

Account takeover is when somebody gains access and takes control of one or more of your accounts without your knowledge or permission. At that point, they can use the account just as you would, potentially using it to make fraudulent transactions, transfer money or gain access to additional accounts, for example. Account takeover fraud accounted for 53% of all existing-account fraud in 2019, according to Javelin.

Since criminals need access to your user credentials to break into your accounts and impersonate you online, keeping this information safe is vital. This involves creating strong passwords that are unique to each of your accounts. Opting for two-factor authentication and using a VPN when accessing public Wi-Fi can add an extra level of security.

If you think you've been the victim of an account takeover, change your passwords (especially if you use the same one for multiple accounts) and contact customer support to see what recourse you may have. Many services allow you to see a list of devices your account has been logged in from, and shut down any log-in instances that may seem suspicious. If, for example, your bank account shows a log-in session from an iPhone in Florida and you're an Android user living in Los Angeles, it's possible your account has been compromised.

Debit Card Fraud or Credit Card Fraud

Debit and credit card fraud occurs when someone uses your card without your permission. Even if a criminal doesn't have your physical card in hand, they can still make unauthorized transactions with your credit card number, PIN and security code. Someone could even use your card information to try to gain access to your other accounts. Either way, fraudulent activity could potentially hurt your credit in several ways, such as by causing your credit card balances to spike.

The good news is that many card issuers have systems in place to help prevent and identify credit card fraud before it results in long-term harm. If you suspect this type of identity theft, contact your card provider as soon as possible to prevent more unauthorized charges. Most won't hold you accountable for charges you didn't authorize.

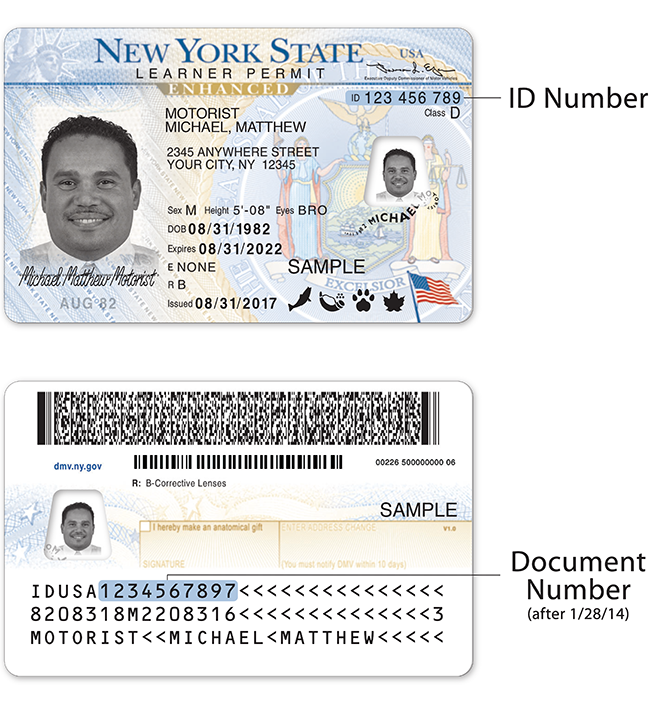

Driver's License Identity Theft

If your wallet goes missing, you may be most concerned about your debit and credit cards. It's easy to overlook your driver's license, but this little card can be a golden ticket for thieves, as it contains your address, driver's license number and other sensitive information. Driver's license identity theft takes many forms, whether your license number is stolen in a data breach or someone physically steals your wallet.

Once your driver's license number is in someone else's hands, a criminal could falsely use it during a traffic stop to avoid a citation—which means it could end up on your driving record. It's a form of criminal identity theft that could even result in an erroneous warrant for your arrest. If your license goes missing, report it to the police and the DMV.

Mail Identity Theft

This type of identity theft has gotten more sophisticated in recent years. One mail identity theft scam involves stealing checks out of mailboxes, then altering and cashing them. Other con artists have been known to intercept credit and debit cards to rack up unauthorized charges. Also be mindful about the mail you throw away. Anything containing account statements, banking information or other personal details can be stolen and used against you. If you've been the victim of mail theft or tampering, you can report it to the U.S. Postal Inspection Service at 877-876-8455.

Online Shopping Fraud

Online shopping fraud can happen in several ways. Some criminals have mastered the art of hacking their way into website accounts, then use your saved card information to make unapproved purchases. This can happen in many ways, but a common situation occurs when shoppers use their accounts while connected via an unfamiliar Wi-Fi network, such as one at a coffee shop. Hackers can set up seemingly legitimate networks with the intention of stealing the information of anyone who connects. That's why it's always smart to shop, do your banking and handle any other sensitive information on a private Wi-Fi network you trust.

Another form of this type of fraud involves compromising the website itself and gaining access to accounts that way, either by stealing customer information or redirecting them to a phony website. Pay close attention to the URL of the website you're using, and check to see if the website is secure before entering your credit card information. Misspellings, low-quality images or too-good-to-be-true deals may also be red flags for fraud. If you're skeptical, don't go through with a purchase, or find it from another retailer you can trust.

Social Security Number Identity Theft

Your Social Security number can be a very powerful tool for fraudsters, especially if they also get their hands on other personal information that can be used together to open fraudulent accounts in your name. This can lead to delinquent accounts showing up on your credit reports and affecting your credit scores. That's why keeping your Social Security card in your wallet is so risky. Instead, store it in a safe place and shred any documents containing your SSN before throwing them away.

When periodically checking your credit reports, check your identifying information closely. Variations of your Social Security number will be listed. Names, addresses or other identifying information you don't recognize could be signs of fraud. Those who've been victimized can report it to the Social Security Administration and also notify their state's tax office.

Senior Identity Theft and Scams

Senior identity fraud can take many forms, and elderly citizens are particularly vulnerable to cybercriminals. This includes tech scammers who call asking for passwords and personal information. Many will say they're from the IRS or Medicare office to gain trust; others even pose as grandchildren who are in trouble and need money. The Federal Trade Commission reports that older consumers who experience fraud typically incur greater financial losses than younger folks. Warning the seniors in your life about these scams can help prevent them from being victimized.

Child Identity Theft

Many child identity theft cases are perpetrated by someone within the family. Ill-intentioned family members can use Social Security numbers, birthdays, addresses and more to open fraudulent accounts. They may also apply for government benefits, take out loans or find other ways to rack up debt in the child's name. This can come back to haunt the victim when they're old enough to apply for legitimate credit on their own, only to find delinquent accounts and unpaid balances. If your child has a credit report, freezing it can prevent further fraud while protecting them from future attacks.

Tax Identity Theft

This type of identity fraud happens when someone uses your personal information, including your Social Security number, to file a tax return in your name and collect a refund. Tax identity theft is usually identified when the victim goes to file their tax return and finds that one has already been processed for them.

Beware of any communication from someone posing as an IRS official requesting private information. The IRS will never contact you in person or by phone or email without first sending notice through the mail. If you've been the victim of tax identity theft, you'll want to fill out an Identity Theft Affidavit with the IRS.

Biometric ID Theft

Biometric ID theft is a very real form of fraud that involves stealing or spoofing a person's physical or behavior characteristics to unlock a device—think facial or voice recognition to unlock your phone, or to tap into your other devices. Biometric ID theft can be a goldmine for hackers, who can gain access to digital wallets and loads of private information. To protect yourself from this type of identity theft, update your devices as recommended. Also be sure your biometric data is being stored securely and safely by a company that requests it. If it isn't, opt out.

Synthetic Identity Theft

Find Driver License Number By Ssn Illinois

Synthetic ID fraud is the fastest-growing kind of financial crime in the U.S., according to consulting firm McKinsey & Company. It's a sophisticated operation that draws on a mix of real personal consumer data, such as Social Security numbers, addresses and birthdays, from a variety of people. This information is blended together to create new fictitious identities that are designed to look like real consumers with good credit.

From there, criminals can open new accounts, apply for credit, receive auto loans and commit other types of financial crimes. If you start to receive mail or phone calls asking about new credit accounts, or you get mail addressed to a different name, these could be signs of synthetic ID theft.

Medical Identity Theft

This kind of identity theft happens when someone poses as another person in order to receive medical services. There are many ways your medical data could fall into the wrong hands. The medical/health care sector had the second-highest number of data breaches in 2019, according to the Identity Theft Research Center.

No matter how it happens, medical identity theft could result in bills for medical services, prescriptions or goods you never requested or received. Making a habit of reviewing your medical claims can help you spot fraud and take steps to remedy it. This involves filing a police report and contacting your insurer and medical providers to correct your medical files. You can also consider filing a health privacy complaint with the U.S. Department of Health & Human Services online or by calling 800-368-1019. If you suspect Medicare fraud, you can report it to 800-HHS-TIPS.

Mortgage Fraud

Mortgage fraud doesn't just apply to buyers and sellers who lie on their mortgage applications. It can also occur if an identity thief steals a homeowner's Social Security number or comes across their mortgage account number. With this information, it might be possible to take out a home equity line of credit or second mortgage, then make off with the money. If it happens to you, contact your mortgage lender immediately.

Home Title Fraud

Home title fraud is when a scammer gains possession of the title to your property. By stealing other components of your identity, they may be able to transfer the ownership on your property title to themselves. At that point, they can use your home equity to gain access to loans and lines of credit. The repercussions can come as a terrible shock to the rightful homeowner, who could face unexpected foreclosure notices. Prevent home title fraud by periodically checking your home information with your county's deed office. If you suddenly stop receiving things like your tax bill or mortgage bill, that's another potential cause for alarm.

Lost or Stolen Passport

Find Drivers License Number Using Ssn Lookup

A valid passport number can fetch a hefty price on the dark web. It's a business that helps criminals turn a profit by falsifying travel documents for those willing to pay top dollar for them. This can spell trouble for consumers who've lost their passport or are victims of theft, especially if it happens while they're away from home. If your passport number has been compromised, the U.S. Department of State recommends reporting it as lost or stolen. This will subsequently invalidate it so that it can no longer be used for international travel. Still, the victim will have to cover the fees to get a new passport.

Internet of Things Identity Fraud

Everything from smartphones to household appliances to cars are now synced up to the internet and linked to one another. Smart devices that can tell you your day's schedule while you brush your teeth, for example, are certainly convenient, but this so-called internet of things (IoT) has also created a new vulnerability point for hackers to exploit. This type of identity theft occurs when someone exploits a security flaw in an internet-connected device to gain access to your personal data. Since devices are almost always connected to important user accounts (such as your email), each device potentially represents an entry point for a hacker.

If you use these devices, be sure to periodically check your financial statements and credit reports for signs of fraud. If you spot something fishy, change your passwords on all internet-connected devices as soon as possible. Secure your home's wireless network with a secure password, and make sure all smart devices use the network you've set up. Or, you may decide that these devices aren't worth the risk, and avoid bringing them into your home altogether.

What Should You Do if You're an Identity Theft Victim?

If you are a victim of identity theft, you should report it immediately. Here are some other things you can do if you suspect you've been a victim:

- File a police report, which is important to protect yourself if an ID thief starts using your information to commit crimes. Get copies of the police report—you may be asked for them when notifying your insurer, medical providers, the credit bureaus and others that you have been victimized.

- File an identity theft complaint with the Federal Trade Commission online or call the FTC's toll-free hotline at 877-IDTHEFT (438-4338).

- Consider placing a freeze or fraud alert on your credit reports.

Monitor Your Credit to Spot Potential Identity Theft and Fraud

Finding Drivers License Number Using Ssn

Being persistent by monitoring your accounts and reviewing your personal information is the best way to stay on top of potential threats. First and foremost is your credit. If someone opens a fraudulent account in your name, you'll want to be the first to know, especially if it's dragging down your credit scores. Experian's free credit monitoring takes it a step further and offers real-time alerts so you'll get a notification whenever a key change occurs. You can even review and correct inaccuracies on your credit report at no charge.

Find Driver License Number By Ssn Indiana

There are all kinds of identity theft and fraud—and innocent consumers are unfortunately easy prey if they aren't paying attention. Staying on top of your credit is crucial. Experian allows you to pull your credit report at no charge to help you spot potential identity fraud sooner. Detecting threats and responding to them quickly is the best way to safeguard your financial life.